Need to translate benefits in kind to Malay. Accommodation or motorcars provided by employers to their employees are treated as income of the employees.

List Of Tax Deduction For Businesses Cheng Co Group

These contributions are paid for by the employer at a rate of 138 of the determined value of the benefits in kind.

. Lets assume the taxpayers tax rate is at 20 the Tax on BIK is. Inland Revenue Board of Malaysia. View PR_11_2019 - BENEFITS IN KINDpdf from TAX 2033 at Tunku Abdul Rahman University.

Discover the critical impacts of being kind to our community. 112019 provides for the following exemptions. Ascertainment of the Value of Benefits in Kind 3 6.

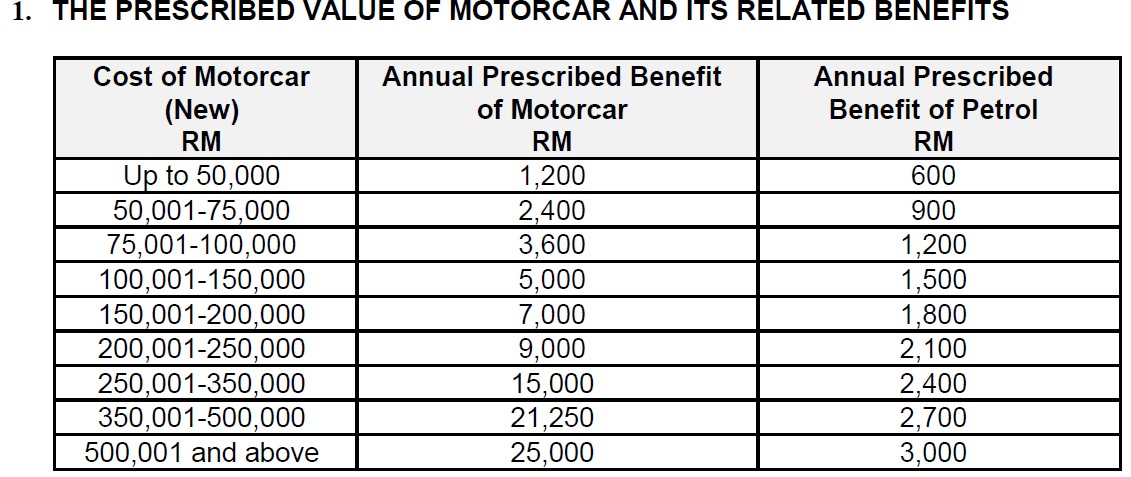

15 March 2013 Pages 4 of 31 a The formula method and b The prescribed value. Motor cars provided by employers are taxable benefit in kind. Value of car in a year.

Under this method each BIK provided to the employee is ascertained by using the formula. Benefits in Kind 2 5. Annual Defined Value of Living Accommodation.

112019 Date of Publication. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. In Malaysia company car benefit falls under Benefit in Kind or BIK in short form.

Tax Exemption on Benefits in Kind Received by an Employee. In this article Seekers will share a review of 3 types of allowances with reference from the Inland Revenue Board of Malaysia LHDN tax ruling and how the allowances affect the tax payment. 30 of Gross Employment Income under Section 13 1 a RM.

RM20100 X 20 RM4020. Generally non-cash benefits eg. Relevant Provisions of the Law 1 3.

Formula BIKVOLA calculation. Here are the benefits that are usually offered to expatriates in Malaysia. Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use of the car and petrol provided is benefit-in-kind and taxable to Leong who is receiving the benefits as the car which is provided to the Leong is regarded to be used privately if.

Kind Malaysia Virtual 2021 I 7-9 September 2021 Connecting Corporates with Civil Society - Time To Be Kind. RM12000 X 20 RM2400. Remaining working month in a.

The Distinction Between Perquisites And Benefits In Kind 2 5. Monthyear of deduction agreed by the employer. Other Benefits 14 8.

These benefits are normally part of your taxable income except for tax exempt. Total taxable BIK income. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND PUBLIC RULING NO.

32013 Date of Issue. Lets have a look at how you can declare it by giving you a real-life scenario. 12 December 2019 Page 2 of 27 b Where the relationship does not subsist the.

A type of financial compensation for the expatriate to relocate to Malaysia. Benefits-in-kind are benefits provided by or on behalf of your employer that cannot be converted into money. Heres how you say it.

All Benefits-in-Kind are technically taxable but Paragraph 8 of the LHDNs Public Ruling No. Under the MTD system it is mandatory for an employer to deduct tax from an employees total gross monthly remuneration which includes perquisites Benefit-in-Kind and VOLA etc. In the above example.

What is Benefit In Kind BIK. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee. RM 10000 x 12 x ⅓ RM 40000.

There are 2 methods specified by LHDN to determine the value of BIKs. BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging. One overseas leave passage up to a.

Particulars of Benefits in Kind 4 7. Annual Defined Value. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

Benefits in kind can be reported and taxed in two.

Holiday13 960x960 Groovykindalove Beauty Gift Guide Benefit Cosmetics Makeup Set

Compare And Apply For A Debit Card In Malaysia Debit Instant Payday Loans Business Credit Cards

Green Design Packaging Fancy Packaging Geothermal Heating

Updated Guide On Donations And Gifts Tax Deductions

Benefit In Kind Living Accommodation How To Declare In Malaysia

Public St Partners Plt Chartered Accountants Malaysia Facebook

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Fire Termite Resistant Pallets From Coconut Husk That Stopped Felling Of 200 Million Trees A Coconut Health Benefits Benefits Of Coconut Oil Health Benefits

Axis Capital Tips For First Time Life Insurance Buyers Life Axis Insurance

Real Time Applications Of Smart Contracts And Blockchain Technology Blockchain Technology Blockchain Word Reference

Spirulina The King Of Aquatic Herb Come With All Benefits Spirulina What Is Spirulina Health And Beauty Shop

List Of Tax Deduction For Businesses Cheng Co Group

Benefit In Kind Bik Steve Ting Accounting Nf 1926 Facebook

Public St Partners Plt Chartered Accountants Malaysia Facebook